|

October 1, 2018

By Dan McGuire

WILCOX, NE—October 1, 2018: “The Trump Administration should be paying corn farmers at least $.50 per bushel if not $1.00 per bushel in compensation for the low prices resulting from an estimated 800 million bushels of lost domestic corn demand resulting from the ethanol waivers EPA and the Administration has provided big oil companies since 2017,” said Gale Lush, American Corn Growers Foundation (ACGF) Chairman, a corn, soybeans and wheat farmer from Wilcox, NE. “It’s one thing to kill export markets for corn with this tariff war. It’s even worse to kill homegrown domestic ethanol-driven corn demand right here in our own American market. Congress also needs to prove they have learned the farm policy lessons of the past 40 years, including the fact that U.S. corn exports in 2018 are only back to the level of 1980. Fortunately, ethanol had stepped in and was saving us temporarily with stronger corn prices. Without the ethanol Renewable Fuel Standard (RFS) farmers and rural America would have had an economic meltdown waiting for the ‘export-oriented, free trade’ farm and trade policy to deliver as promised. Congress needs to get on the ball and take whatever measures are necessary to protect and strengthen the RFS because Trump’s tariff trade war is hurting corn exports and the EPA’s big oil company RFS waivers are destroying domestic corn demand. This all adds to U.S. corn inventory and lower prices. A farmer-owned grain reserve in the new farm bill helps manage supply without stimulating competing foreign grain production from higher prices. USDA should pay farmers commercial storage rates for storing corn and soybeans in on-farm storage because Trump’s tariffs and ethanol waivers will cause us to store grain for years.”

Dan McGuire, ACGF Policy Director said, “RFS ethanol waivers for big oil companies have reduced domestic corn demand by about 800 million bushels by some estimates, adding that 800 million bushels to corn ending stocks. USDA’s September 12th WASDE report projects 2018/19 corn ending stocks at 1.774 billion bushels and corn prices at $3.50. Had ethanol waivers not cut that 800 million bushels of corn demand corn ending stocks would be 974 million bushels. That’s important because the higher ending stocks in USDA’s latest report translate to an 11.7% ending stocks-to-use ratio. That ratio would be 6.4% had that 800 million bushels been utilized for domestic ethanol and corn prices would be higher. In 2011/12 when corn ending stocks were 989 million bushels corn prices averaged $6.22 per bushel. That is strong historical evidence. Congress should immediately add at least $.50 per bushel, and a strong case can be made for adding $1.00 per bushel for corn in the new farm bill as compensation to corn farmers for the lower corn prices caused by tariffs and weakened domestic ethanol demand from the ethanol RFS waivers that the EPA keeps giving oil companies. $.50 per bushel on a 14.8 billion bushel corn crop equals $7.4 billion. $1.00 per bushel equals $14.8 billion. The Administration is responsible for this negative trade, ethanol demand and low corn price situation. They need to compensate farmers.”

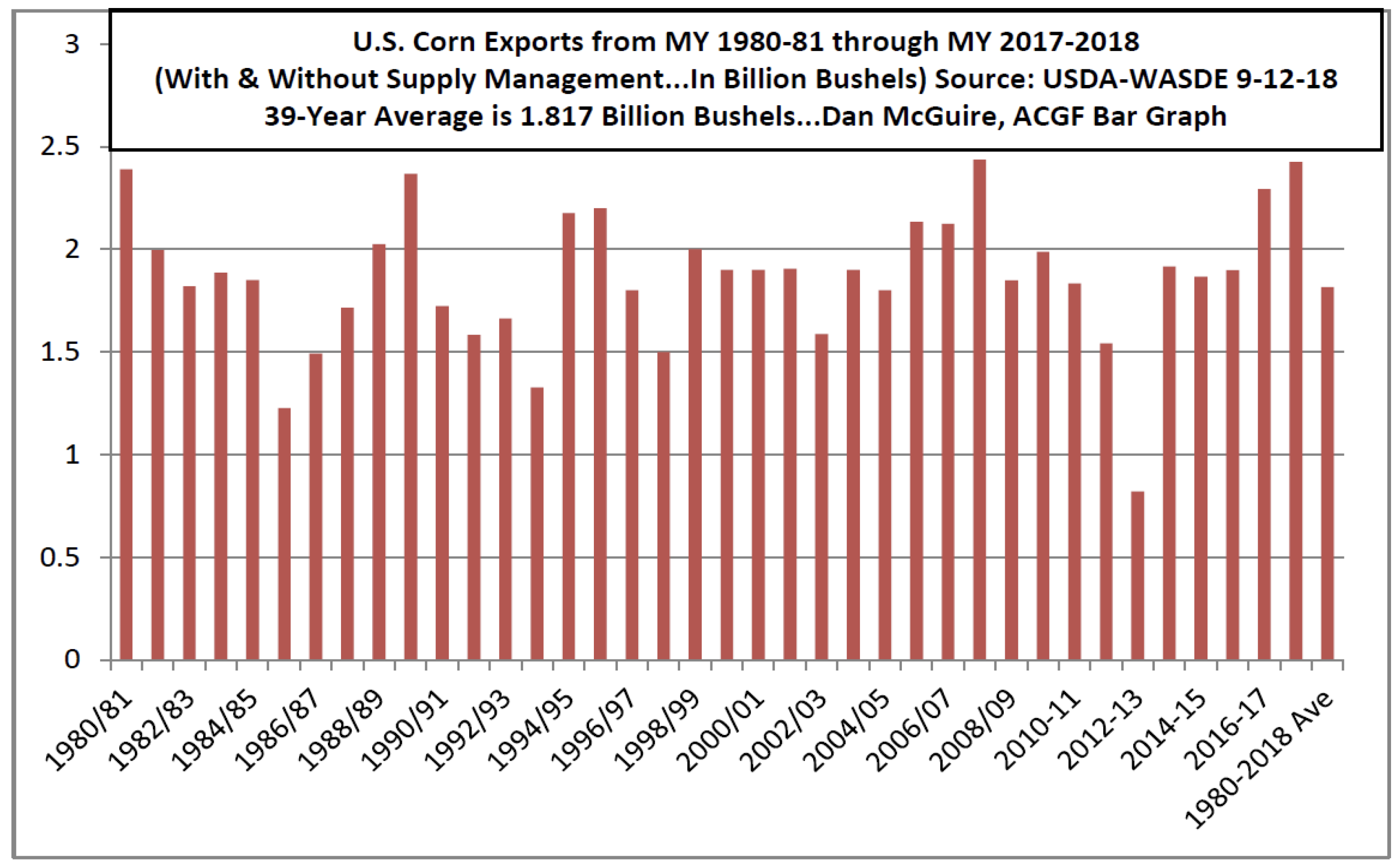

McGuire added, “Regarding exports, USDA’s own historical export facts and database tell the story. Congress irresponsibly bought into the ‘export-oriented’ farm policy mantra from big multinational grain trading companies and their industry lobbyists. That shaped the 1985 farm bill and began dismantling supply management tools. Then the 1996 Farm Bill eliminated the remaining farmer-oriented supply management programs. Large grain buyers (processors, exporters and large livestock feeders) got their way in farm policy. They projected that U.S. grain exports would grow dramatically. They were wrong. Thirty-nine years later, in the 2018-2019 marketing year, USDA projects corn exports at only 2.4 billion bushels, right back to the export level of 1980. U.S. corn exports occasionally exceed 2 billion bushels when foreign droughts bump up demand as is the case. The 39-year U.S. corn export average is only 1.8 billion bushels. Congress needs to recognize these facts. Exports are very important to help reduce excessive corn inventory. But, exports need strong ethanol demand every year to keep corn ending stocks managed to strengthen corn prices. The current tariff trade war is causing long term damage to U.S. export markets. It facilitates additional foreign crop competition for years. Congressional leaders must pressure Administration officials, including EPA, to cease granting RFS ethanol waivers to big oil companies. Congress needs to get a grip on policy by strengthening corn demand through a stronger ethanol RFS.”

Note: An ACGF 39-year U.S. corn export bar graph and a November 15, 2017 article, Impact of Supply Management Programs on Crop Exports, by Harwood D. Schaffer and Daryll E. Wray of the Agricultural Policy Center at the University of Tennessee follows this news release and provides a concise historical perspective on past farm bills and U.S. corn and grain exports.

Impact of supply management programs on crop exports

by Harwood D. Schaffer and Daryll E. Ray Agricultural Policy Analysis Center

Nov 15, 2017

We have heard over and over again from people who do not like crop supply management programs. They tell us that these programs put a cap on exports, particularly corn exports and especially if loan rates are near the full cost of production.

They argue that when the U.S. implements a reduction in acreage to keep reserve stocks from getting too large, foreign export competitors take that as a signal and increase their acreage, capturing exports that should have accrued to the U.S.

Let’s look at the numbers and see what they tell us. In 1979 and 1980 U.S. corn exports exceeded 2 billion bushels for the first time. The 1985 Farm Bill was designed to bolster U.S. exports by reducing the loan rate. The 1996 Farm Bill eliminated the last vestige of supply management.

And still, in the 36 intervening years, U.S. corn exports reached the 2-billion-bushel level only 8 times. Non-US corn exports exceeded 3 billion bushels in each of the last 6 crop years.

Total corn exports from non-US countries have equaled U.S. corn exports over the last 20 years, while in 1979 non-US corn exports were 16 percent of those of the U.S.

About this time in the argument someone says to us, “Yes, but you are not taking into account the corn that is exported in the form of beef, pork, and poultry.” And that is true. The corn embodied in net meat exports is important, but even with increasing net meat exports total feed demand remained flat at an average of 5.4 billion bushels per year over the last 20 years. Increased corn exports embodied in meat has not been sufficient to keep year-ending corn stocks from increasing since the end of the ethanol boom.

Talking about ethanol, the U.S. shifted from a net importer of ethanol to a net exporter in 2010. Net exports of ethanol have averaged 15.5 million barrels for the last seven years.

As important as they are, net meat, and ethanol exports have not been sufficient to keep year-ending corn stocks from increasing in recent years.

The principal signal that brings extra acreage into production is not a policy that sets the loan rate near the full cost of production, but rather one that allows the price to get well above the full cost of production. That catches the attention of farmers worldwide and the extra acreage that comes into production is slow to be taken out of production, even with an extended period of low prices; we are talking about decades not years.

Whether the U.S. uses a program that depends on crop price supports (supply management in the pre-1996 era) or one that uses programs that support total farm revenue (1997 to the present), the impact of changing U.S. agricultural policy on corn exports is negligible.

So, what is going on?

First, farmers elsewhere in the world are no different from farmers in the U.S.; they want to feed their own people. The result is that world corn exports have declined as a percent of world production.

Second, even when the world percentage of production that is exported has increased as is the case for barley, soybeans, rice, and wheat, the U.S. share of world exports has declined. The U.S. has a mature agricultural economy while many other countries are playing catch-up, both in terms of technology and acreage.

Because of the strength of the U.S. agricultural sector, with its ability to produce crops in excess of domestic demand, and the dominant role the U.S. has played in the world since WWII, the U.S. has become both the oligopoly price leader and the residual supplier.

Basic agricultural commodities around the world, with a few exceptions, are priced off U.S. markets taking into consideration shipping costs to any given location. To make an export sale, all other countries need to do is offer a delivered price that is slightly lower that the U.S. price, taking into account any variation in quality. If the price in the U.S. declines, the price elsewhere declines as well.

For many crops and their substitutes, the U.S. price is the de facto world price. The policy by which the 1985 Farm Bill allowed the loan rate to be lowered in attempt to allow the U.S. to get its price down to the world price was an exercise in futility.

Because of its dominance in the market and its ability to produce and store agricultural crops, the U.S. is the world’s residual supplier. Most countries only purchase from the U.S. when their local production is inadequate and the U.S.’s export competitors have little or nothing to sell.

Whether the U.S. farm program utilizes a price support mechanism—with either high or low loan rates—or a farm revenue support mechanism makes little difference on U.S. crop exports. Either way, the U.S. remains the oligopoly price leader and residual supplier for basic storable farm commodities.

Harwood D. Schaffer is an adjunct research assistant professor, Sociology Department, University of Tennessee, and director of the Agricultural Policy Analysis Center. Daryll E. Ray is an emeritus professor, Institute of Agriculture, University of Tennessee, and retired director of the Agricultural Policy Analysis Center.

Download a printable copy

|